Trade Advisor

The Trade Advisor provides guidance on how to trade most effectively to optimal.

Together, Michaud optimization and the Michaud-Esch rebalance test provide an alternative framework for managing investments. In this system, a manager need not hold precisely the current optimal portfolio, but needs to be sufficiently close to optimal. When holdings drift away from the evolving new optimal target, then the Michaud-Esch rebalance test signals that it is time to trade the portfolio.

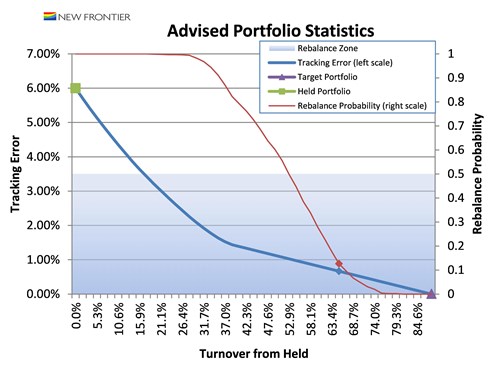

One implication of this new framework for financial management is that in many cases the full trade to the new optimal may have more turnover than necessary to keep investments on track. In other words, when investments become too different from the current optimal and the rebalance test score is high, the management framework requires only that the trades get the portfolio back close to the optimal, where the rebalance signal is no longer triggered.

Maintaining an optimal portfolio means staying close to optimal, or equivalently not letting tracking error get too large. Reducing unnecessary noise-based trading means minimizing turnover, or only incurring the turnover necessary to stay close to optimal.

When a portfolio needs to be traded, there is a shortest (minimum turnover) trading path that will maximize the reduction in tracking error. This is the most efficient trading path, and it is calculated with the US patent-pending New Frontier Trade Advisor. The stopping point can be determined by examining the Michaud-Esch rebalance score, which the Trade Advisor also calculates for all partial trades along the efficient trading path. This tool, along with the optimizer and rebalance test, allows the most efficient and effective trading policy to be set and followed, ensuring disciplined management over time conforming to the best performing target portfolios. The tool is also flexible enough to constrain assets as needed in the trading process to either hold position or trade as desired, adjusting the other assets to the most efficient trading path under the manager’s trading constraints.

The New Frontier Trade Advisor is the perfect companion to the Michaud optimizer and the Michaud-Esch rebalance test, and the three procedures form a complete system for creating the best model portfolios and tracking them strictly and efficiently with real-time investments.

An example of a Trade Advisor Efficient Trading Path